To Add new Recurring invoice go to Sales -> Recurring Invoices and click on the button Add new Recurring invoice.

The Recurring Invoice Creation page consists of the following fields:

Customer: Select the relevant Customer from the Customer list.

Currency: In this field, the data is filled by default based on the customer’s currency.

Recurring Invoice Status: Recurring Invoice status field allows the admin whether to Published/Draft the Recurring invoice to the customer. If the Recurring invoice status is published then it will be displayed in Customer’s panel and if the status is Draft it won’t be visible in the customer’s panel.

Sale Agent: This field allows to assign a relevant third party.

Address and Delivery Address: Customer’s addresses are given in these fields, in order to deliver/ship the Recurring Invoices.

Recurring Period — It shows that selection of duration like Days/Weeks/Months to recur the Recurring invoice.

Recurring Value — Value of Recurring period.

Example: Consider recurring period is weekly, then the value is taken 2, it shows the total recurring period is 2 weeks.

Recurring Type — It is based on Recurring Period. It is selected automatically by selecting Recurring Period.

Total Cycles — How many times the Recurring invoice will be recurred to the particular customer from giving on respective dates.

Example :

The Recurring invoice due date is 02/03/2019, Recurring Period is Weekly, Value is 2, Total Cycles is 2.

Then it will have Recurred on 09/03/2019 and 16/03/2019.

Payment methods: Select the payment methods you want your customer to pay with. All enabled payment methods will be presented to the client as options so that they can choose the payment method of their choice.

Title: Entity that defines the name of Recurring Invoice.

Prefix/Quantity: This prefix is set to a default value from Invoice Settings.

Recurring Invoice No: This number is automatically generated by default or can be assigned manually.

Reference: It refers to a particular Recurring invoice.

Additional Tax/Discount: Additional Percentage/value sum ups to Total Recurring Invoice amount.

Additional Tax/Discount Format: Tax/Discount will be added after/before the product was bought.

- Item/Product: The product name can be either manually typed or picked from the listed options.

- Quantity: The number of units being charged.

- Unit Price: The amount you charge per unit of the items/products.

- Tax Rate: It can be applied to the item/product by selecting the relevant tax from the drop-down list.

- Discount: It can be applied to any particular item either as a percentage or a fixed value.

- Description: Additional information about the item/product. This will help the customer to understand the product’s features in a better way.

The ‘+‘ icon symbol beside some fields allows you to directly add the particular’s through a Pop-up menu to their respective modules.to add directly from here to those respective modules.

The ‘+‘ icon symbol beside some fields allows you to directly add the particular’s through a Pop-up menu to their respective modules.to add directly from here to those respective modules.

In order to get back the deleted Recurring invoices, click on the Restore button in the Trash page and they will be restored to Recurring invoice list.

In order to get back the deleted Recurring invoices, click on the Restore button in the Trash page and they will be restored to Recurring invoice list.

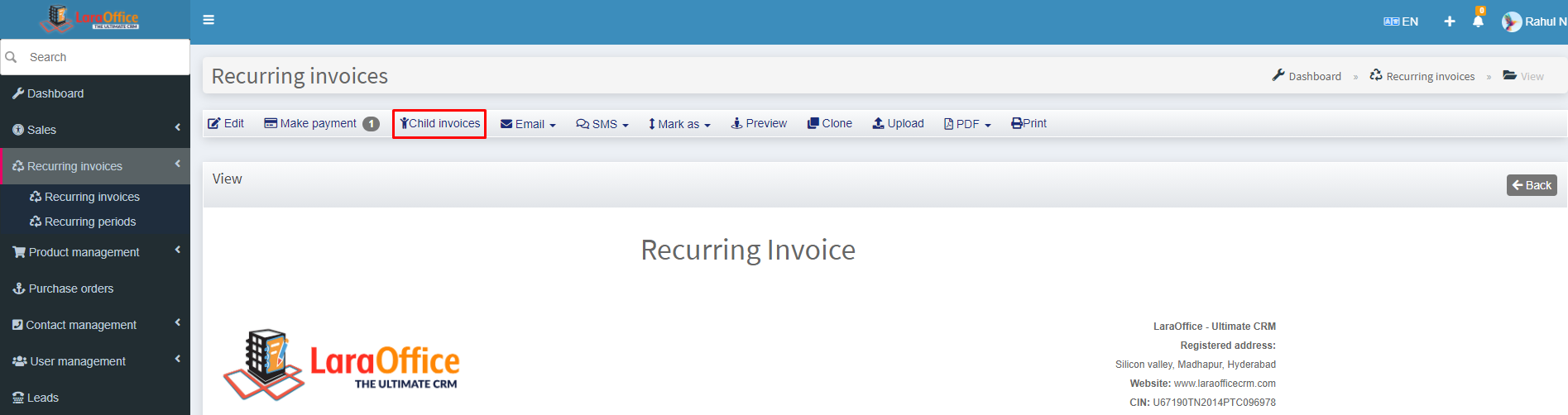

Child Invoices: When the invoices from this Recurring Invoice will be generated you will have an overview which invoices are generated from this Recurring Invoice at the Child Invoices tab.

Child Invoices: When the invoices from this Recurring Invoice will be generated you will have an overview which invoices are generated from this Recurring Invoice at the Child Invoices tab.

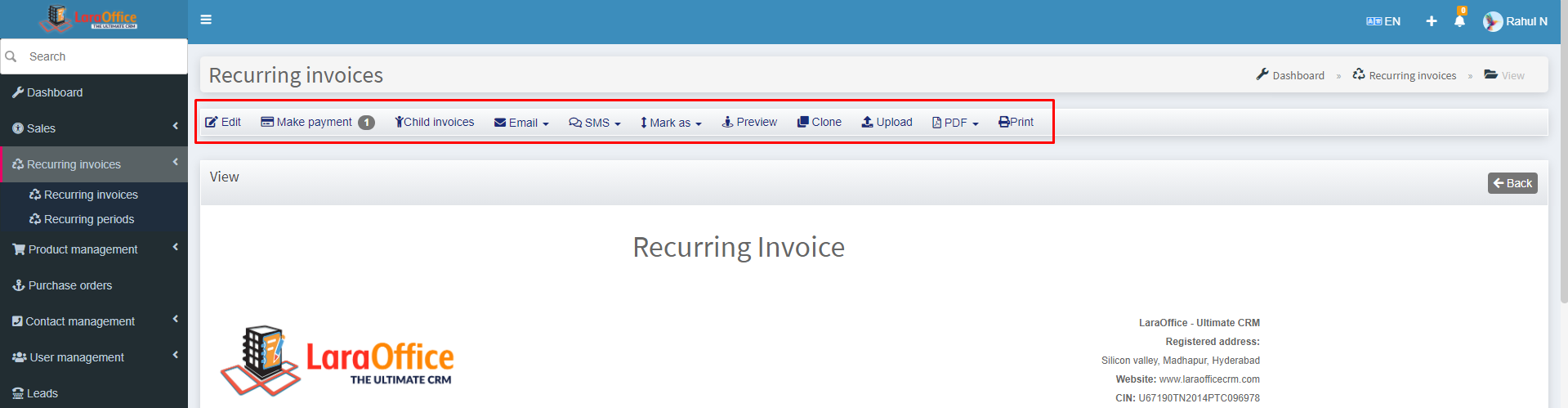

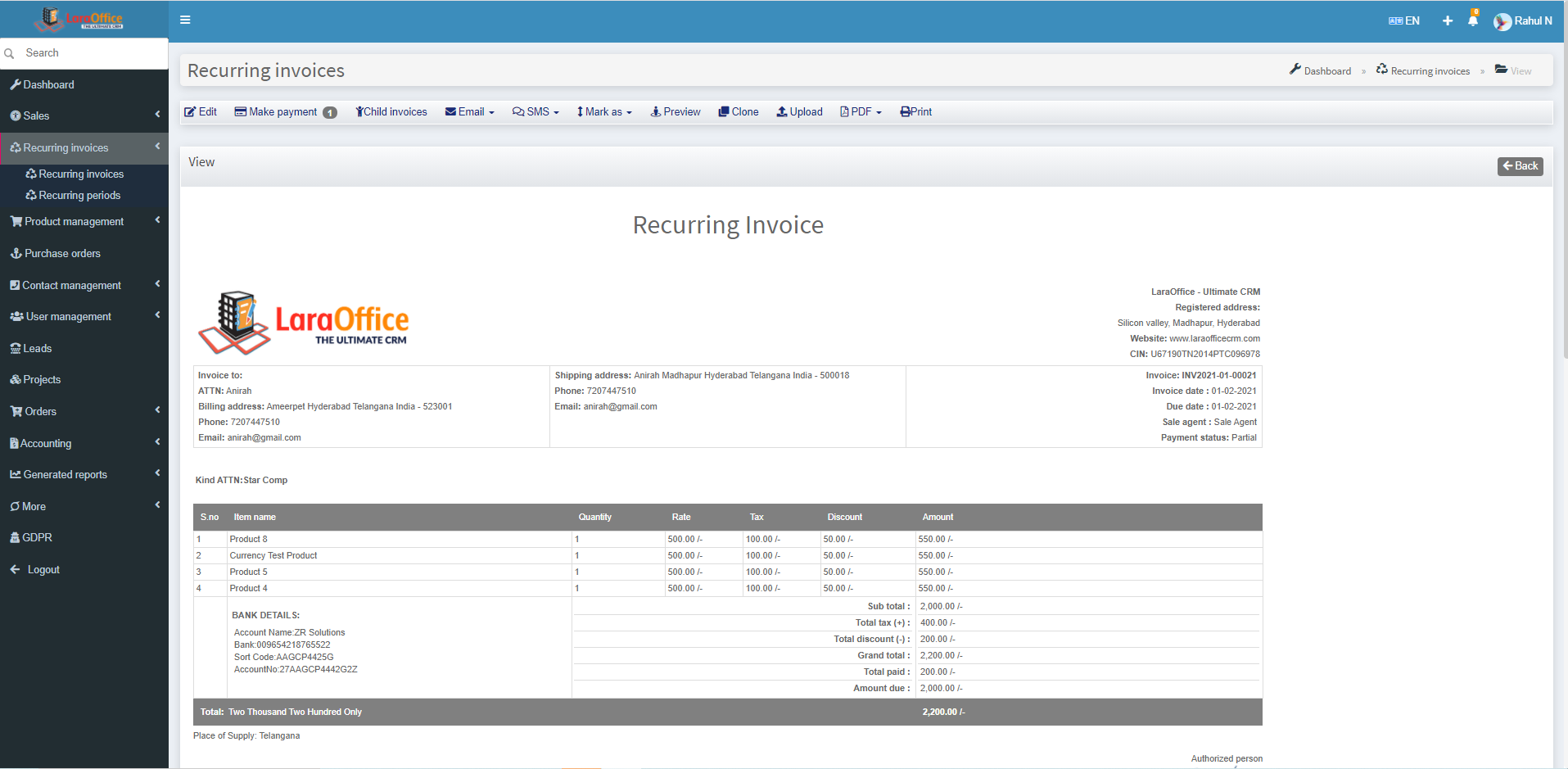

Recurring Invoice View:

Recurring Invoice View: Here we can view the Recurring Invoice Number, Payment status, Customer address, Recurring Invoice details, Payment method, Authorised signature.

Here we can view the Recurring Invoice Number, Payment status, Customer address, Recurring Invoice details, Payment method, Authorised signature.

The ‘+‘ icon symbol beside some fields allows you to directly add the particular’s through a Pop-up menu to their respective modules.to add directly from here to those respective modules.

The ‘+‘ icon symbol beside some fields allows you to directly add the particular’s through a Pop-up menu to their respective modules.to add directly from here to those respective modules. These can again be filtered based on

These can again be filtered based on